how to become a tax attorney in canada

Once you receive your certificate of qualification you are at the same level as JD students in Canada. This typically takes four years.

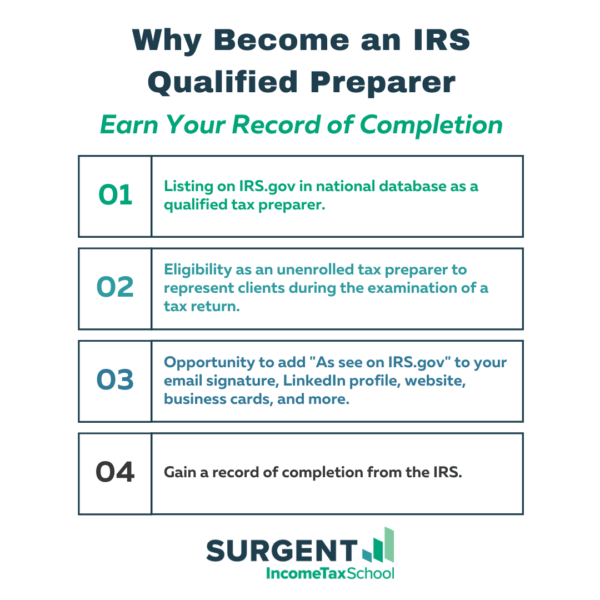

How To Become A Tax Preparer In 4 Easy Steps

CTPCanadaca is here to assist you in becoming certified.

. Aim for earning an undergraduate Bachelors degree You cannot enter Canadian law schools directly from high school. Ontario Grade 12 US Grade 12 GCEGCSE at the AAS level CAPE IB etc. You then need to complete your bar exams and articling requirement unless you are exempted from articling.

Complete the Province of Alberta Bar Admission Course and Articling. Without earning this bachelors degree it will be impossible to gain admission into law school. You must have a full-scale intelligence of the federal tax code and other tax laws.

For specific situations please contact the CRA at 1-800-959-8281. Bachelors Degree LSAT Law School Admission Juris Doctor Law Degree MRPE Bar Examination The first step on that path is to earn a bachelors degree. The best electives for aspiring tax attorneys include general business taxation financial services and estate planning just to name a few.

Study finance economics or business at the undergraduate level. Once your registration fee is paid you will be assigned your CTP registration number. There is no specification in terms of which undergraduate degree should be earned.

Becoming a Lawyer in BC. Study finance economics or business at the undergraduate levelYou can use this as a stepping stone to becoming a tax lawyer in CanadaIf you want to become a lawyer in Canada you need to applyYou can submit your undergraduate transcripts and submit a GPA of 30 for third-year studentsHigh 0 or higher. It is beneficial to major in a finance-related field as an undergraduate and then train in tax law in your law program.

You will need to have recognized credentials if you are going to practice law in Canada. How Do I Become A Tax Lawyer In Canada. Becoming a Canadian tax lawyer requires several specific steps mandated by a provincial law society.

Answer 1 of 2. For them to earn this background they have to complete their undergraduate degree in accounting or business. How Do I Become A Cpa Lawyer In Canada.

To become a tax lawyer you must possess the following basic skills. That is the case whether the reference is to the Canadian domestic tax statute or the roughly 100 double tax and tax information exchange agreements to which Canada is a party or the informal role that the tax-related work product of the OECD. Complete your high school education regardless of your educational system in the world eg.

HOW LONG DOES IT TAKE TO BECOME A TAX ATTORNEY. There are four setps with hundreds of smaller steps in between Get Your Undergraduate Pre-Law Degree in Canada. If you are going to court you need to have a tax lawyer.

Application into Law School. LSAT and Law School Admission. The most common way to become a lawyer in BC is to earn a law degree from a Canadian law school then complete the Law Society Admission Program.

With authorization your representative could do one or more of the following. Tax layers must join their provincial law societies complete training and pass examination requirements. Take the LSAT Law School Admission Test Go to Law School in Canada.

The path to becoming a tax attorney typically consists of the following steps. Tax law can be pretty complex and I cant imagine someone taking their taxes to a tax preparer. The undergraduate degree may be in most any discipline although it is advantageous for an aspiring tax lawyer to major in business economics finance or accounting.

The road to becoming a tax attorney starts with an undergraduate degree from an accredited college or university. Appearing in court is a purely legal activity one for which lawyers have been trained and accountants have not. This recognition requires you to pass the Canadian bar exam and complete an assessment process that shows local employers that you are eligible for hire.

Earn a bachelors degree preferably in accounting business or mathematics. Once you successfully complete your NCA exams you need to apply to NCA for a Certificate of Qualification. School of law covers enough of this topic basically for students who have their attention.

Canadian tax law is a highly challenging stimulating and pivotal part of business law practice of and among the major law firms. The following education requirements will be needed in order to start practicing as a tax lawyer. When you authorize a representative they have access to your tax information on the accounts you choose.

However that is not the only way to become a lawyer in BC. Note To obtain online access to an individuals tax information you must register for Represent a Client prior to sending a copy of the legal documents. Normally a tax attorney should have a background in accounting or business.

The CTP certification enables tax preparers to comply with ever changing legislative demands and to embrace the latest legislation and technology. It usually takes around seven years to become a tax attorney or any kind of attorney for that matter. They can then help you manage your tax information with the Canada Revenue Agency CRA.

While there is no legal requirement to get any sort of certificate but I could not see you being very successful if you did not get training. Canadian tax law is a highly challenging stimulating and pivotal part of business law practice of and among the major law firms. A law degree from outside Canada may be recognized in BC but the applicant must apply to the National Committee on.

For aspiring to become a tax lawyer in Canada this will be helpful. Skills You Need To Become A Tax Lawyer. How to become a lawyer in Alberta.

You must also fathom a business and financial approach. Documents from your undergraduate education or your 3 percent GPA will be required. You can apply at any time to be assessed as it is seen as a separate process to Canadian immigration.

Once you have registered with the Represent a Client service you will be assigned a representative identifier RepID. Use this number throughout your certification process. Dont be afraid to apply to a Canadian law school accredited by the NCAA.

Advice on how to become Canadian tax lawyer foreign lawyer 1 Pursuing a Canadian Common Law LLM to get my NCA certification then look for an articling student job at the tax. An accountant who offers to represent a client in tax court is not properly. While accountants can represent their clients in some Tax Court of Canada cases they should not.

This includes four years of pre-law and a minimum of three years of law school. That is the case whether the reference is to the Canadian domestic tax statute or the roughly 100 double tax and tax information exchange agreements to which Canada is a party or the informal role that the tax-related work product of the OECD. 2 Enrolling first in a Tax LLM then try to get a job as tax advisor and in the meantime enroll in a part time LLM.

Access your personal tax information tax assessment or reassessment.

Tax Accountant Career Overview

Tax Consultant In Canada Tax Attorney Accounting Financial Advisors

Legal Counsel Positions In Toronto Corporate Law Legal Recruitment Law Firm Marketing

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

7 Last Minute Tax Breaks To Take Advantage Of Before The End Of The Year Tax Time Filing Taxes Savings Strategy

Did You Know There S An Estimated 50 000 Lawsuits Filed In This Country Every Day Of The Week Asset Protection Ha Limited Partnership Corporate Law Tax Lawyer

Tax Attorney Vs Cpa What S The Difference Turbotax Tax Tips Videos

Go Online To Find The Job Openings In A Wastemanagement Industry And Select A Job Suits To Your Background Certified Accountant Job Portal Website Job Portal

Cpa Vs Tax Attorney What S The Difference

How To Become A Tax Consultant

Contabilidad Fotos Y Vectores Gratis Income Tax Tax Services Tax Return

Barry L Gardiner Lawfirm Has Been Aorund For 21 Years Ago And Is Well Respected For Its Skilled Efficient A Legal Firm What Is Bitcoin Mining Bitcoin Mining

Requisitos Para Inmigrar A Estados Unidos Family Law Business Law Attorneys

Dummies Guide To Service Tax Income Tax Return Small Business Tax Income Tax

Everything You Need To Know About A Tax Attorney Turbotax Tax Tips Videos